All Categories

Featured

Table of Contents

The rest of their business actual estate deals are for recognized investors just. VNQ by Lead is one of the biggest and well known REITs.

Their number one holding is the Lead Real Estate II Index Fund, which is itself a common fund that holds a selection of REITs. There are other REITs like O and OHI which I am a long-time investor of.

To be an certified investor, you must have $200,000 in annual revenue ($300,000 for joint financiers) for the last two years with the expectation that you'll earn the same or more this year. You can additionally be thought about a certified investor if you have a web well worth over $1,000,000, separately or collectively, excluding their main house.

How long does a typical Accredited Investor Property Investment Opportunities investment last?

These bargains are frequently called personal placements and they don't require to sign up with the SEC, so they don't offer as much details as you would certainly anticipate from, state, an openly traded firm. The certified investor demand assumes that someone who is recognized can do the due persistance on their own.

You just self-accredit based on your word. The SEC has likewise expanded the interpretation of accredited investor, making it much easier for even more individuals to certify. I'm favorable on the heartland of America provide after that reduced valuations and much greater cap rates. I assume there will be proceeded migration far from high cost of living cities to the heartland cities as a result of set you back and innovation.

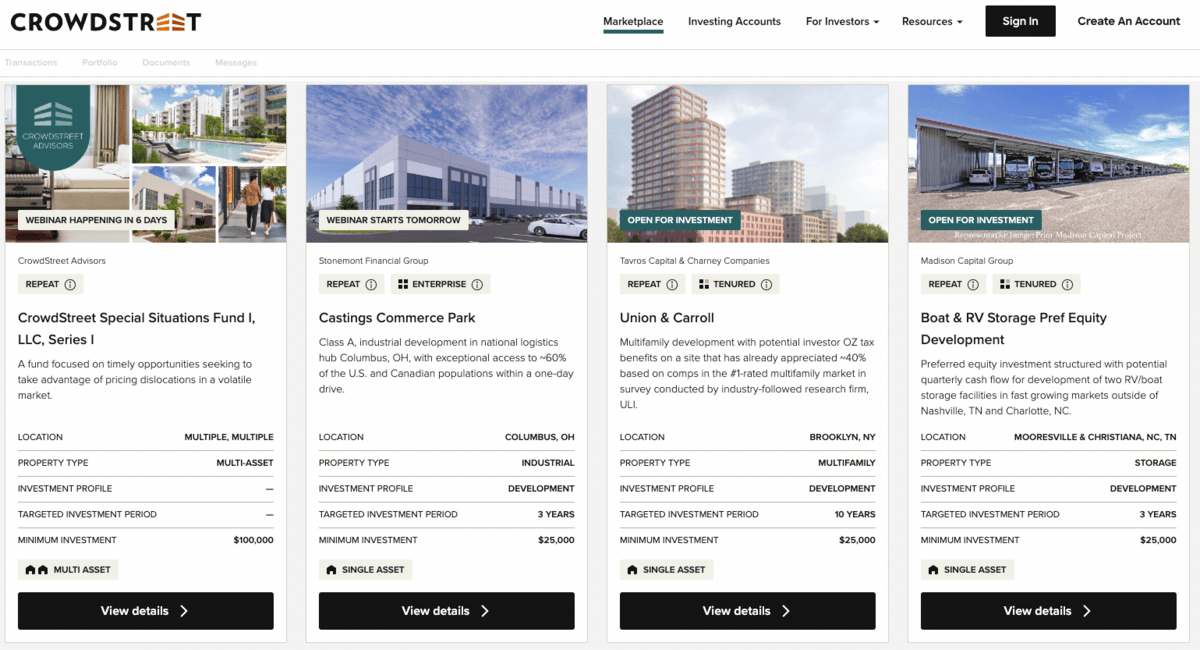

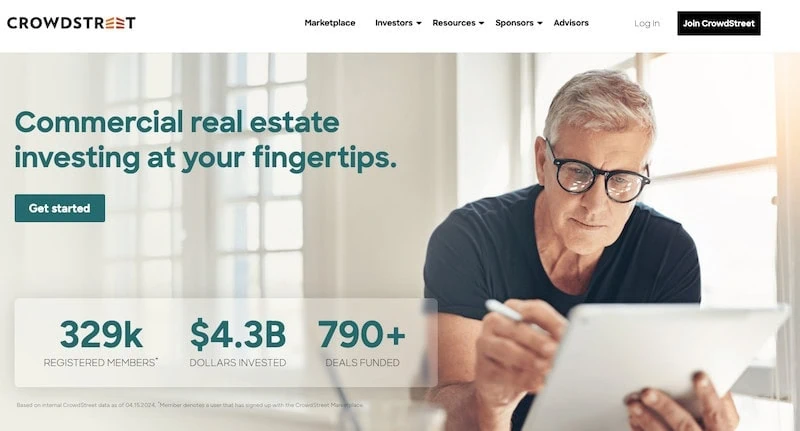

It's everything about adhering to the cash. Along with Fundrise, also look into CrowdStreet if you are a recognized investor. CrowdStreet is my favored platform for certified financiers due to the fact that they concentrate on emerging 18-hour cities with reduced valuations and faster population development. Both are cost-free to register and check out.

Below is my actual estate crowdfunding control panel. If you intend to discover more concerning real estate crowdfunding, you can see my realty crowdfunding finding out center. Sam functioned in spending financial for 13 years. He received his bachelor's degree in Business economics from The University of William & Mary and got his MBA from UC Berkeley.

He hangs around playing tennis and caring for his family members. Financial Samurai was begun in 2009 and is just one of one of the most relied on individual finance sites on the web with over 1.5 million pageviews a month.

Key Takeaways What are taken into consideration the most effective realty financial investments? With the united state realty market growing, financiers are sifting via every offered building type to discover which will certainly aid them earnings. Which sectors and buildings are the ideal actions for financiers today? Keep checking out for more information about the very best kind of property financial investment for you.

What should I look for in a Commercial Property Investments For Accredited Investors opportunity?

Each of these kinds will certainly include one-of-a-kind advantages and downsides that capitalists should examine. Allow's consider each of the options offered: Residential Realty Commercial Realty Raw Land & New Building And Construction Real Estate Investment Company (REITs) Crowdfunding Platforms Register to attend a FREE on-line genuine estate class and find out exactly how to get begun spending in realty.

Various other property properties include duplexes, multifamily properties, and villa. Residential property is perfect for several capitalists since it can be much easier to transform earnings consistently. Naturally, there are numerous domestic genuine estate investing approaches to deploy and different levels of competition throughout markets what might be best for one financier may not be best for the next.

Can I apply for Accredited Investor Real Estate Investment Groups as an accredited investor?

The most effective commercial properties to spend in include industrial, workplace, retail, friendliness, and multifamily tasks. For financiers with a solid emphasis on boosting their regional neighborhoods, commercial genuine estate investing can sustain that focus (Private Real Estate Investments for Accredited Investors). One reason industrial residential or commercial properties are thought about among the most effective kinds of property financial investments is the capacity for higher capital

To read more regarding getting going in , be sure to read this post. Raw land investing and brand-new construction represent two types of actual estate investments that can expand an investor's profile. Raw land refers to any uninhabited land readily available for purchase and is most eye-catching in markets with high projected development.

Buying brand-new building and construction is additionally prominent in swiftly growing markets. While several financiers may be not familiar with raw land and brand-new building and construction investing, these investment kinds can represent eye-catching earnings for investors. Whether you have an interest in developing a building throughout or benefiting from a lasting buy and hold, raw land and brand-new building provide a distinct opportunity to genuine estate financiers.

What are the benefits of Real Estate Development Opportunities For Accredited Investors for accredited investors?

This will certainly ensure you select a preferable location and avoid the financial investment from being obstructed by market factors. Realty investment depends on or REITs are business that possess different business realty kinds, such as resorts, shops, offices, malls, or dining establishments. You can purchase shares of these realty business on the stock exchange.

This provides investors to get dividends while diversifying their profile at the same time. Publicly traded REITs likewise use flexible liquidity in contrast to other kinds of actual estate financial investments.

While this provides the ease of locating properties to capitalists, this sort of realty investment additionally presents a high quantity of threat. Crowdfunding systems are typically limited to accredited investors or those with a high web well worth. Some websites offer accessibility to non-accredited capitalists. The major sorts of property financial investments from crowdfunding systems are non-traded REITs or REITs that are out the stock exchange.

Private Real Estate Deals For Accredited Investors

[Discovering just how to purchase realty does not have to be difficult! Our on-line property spending course has whatever you need to shorten the discovering curve and start spending in property in your area.] The most effective sort of genuine estate financial investment will certainly rely on your private situations, objectives, market location, and recommended investing strategy.

Selecting the ideal residential or commercial property kind comes down to considering each alternative's advantages and disadvantages, though there are a few vital factors capitalists ought to remember as they look for the finest selection. When picking the very best kind of financial investment property, the relevance of location can not be downplayed. Financiers operating in "promising" markets may locate success with uninhabited land or new building and construction, while financiers functioning in more "fully grown" markets might want homes.

Analyze your preferred level of involvement, threat tolerance, and success as you make a decision which building type to purchase. Investors desiring to handle a much more passive function may select buy and hold commercial or houses and utilize a residential or commercial property supervisor. Those intending to take on an extra active function, on the various other hand, might locate establishing uninhabited land or rehabbing household homes to be more satisfying.

Table of Contents

Latest Posts

Tax Lien Houses

Taking Over Property Back Taxes

Tax Home For Sale

More

Latest Posts

Tax Lien Houses

Taking Over Property Back Taxes

Tax Home For Sale